US Inflation Rate May 2025 eases to 2.4% annually, below market expectations. Lower CPI fuels investor optimism about possible Federal Reserve rate cuts. Read full report and market impact.

US Inflation Report May 2025: Softer CPI Sparks Rate Cut Hopes Amid Fed-Trump Tensions

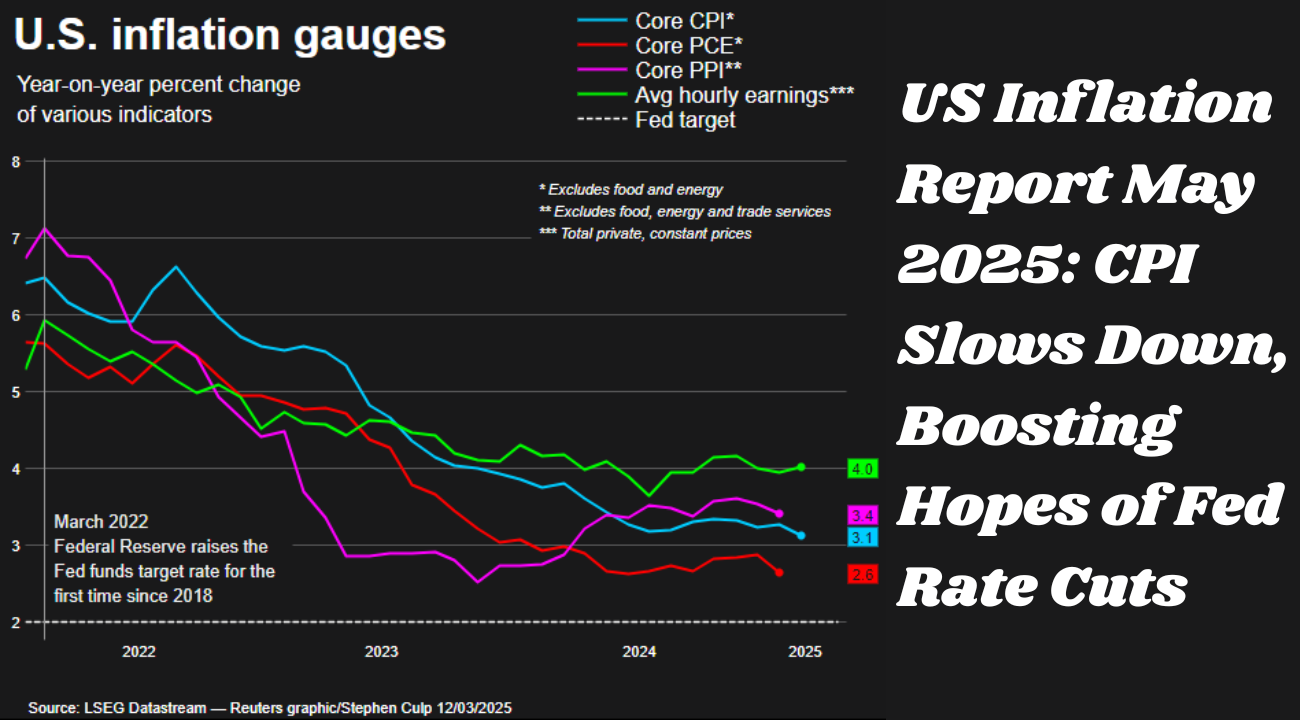

The latest US inflation report for May 2025, released by the Bureau of Labor Statistics (BLS), has caught the attention of investors and global markets. The annual inflation rate in the United States has shown a modest uptick to 2.4%, rising from 2.3% in April. Although it marks the first increase in four months, the figure is still below analysts’ forecast of 2.5%, easing concerns of runaway inflation and strengthening the case for potential rate cuts from the Federal Reserve.

This report plays a pivotal role in guiding investor sentiment, shaping Federal Reserve policy decisions, and influencing market movements across the globe.

Also Read: Vivo T4 Ultra Launches in India with Dimensity 9300+ Chipset, 50MP Triple Camera

Key Highlights of May 2025 US Inflation Data

-

Annual inflation rate: Rose to 2.4% in May, up from 2.3% in April

-

Monthly CPI growth: Increased by 0.1%, compared to 0.2% last month and 0.2% forecast

-

Core inflation (excluding food and energy): Held steady at 2.8% annually

-

Monthly core CPI: Rose 0.1%, below 0.2% in April and forecast of 0.3%

-

Shelter index: Up by 0.3%, contributing most to the monthly increase

-

Energy index: Dropped by 1%, easing overall CPI growth

-

Stock market reaction: Positive, with S&P 500 and Nasdaq 100 futures rising

-

Fed policy outlook: Market now sees stronger potential for upcoming rate cuts

What is Driving the US Inflation Trends?

The Consumer Price Index for All Urban Consumers (CPI-U) showed a 0.1% increase in May on a seasonally adjusted basis. This is notably lower than April’s 0.2% rise and aligns with market expectations. One of the main drivers behind the CPI increase is the shelter index, which climbed by 0.3% in May. In contrast, energy prices fell 1%, helping to moderate overall inflationary pressure.

The core inflation rate—which strips out the more volatile food and energy components—remained stable at 2.8%, the lowest levels seen since 2021. Analysts had anticipated a slight increase to 2.9%, so this flat trend has been interpreted as a positive sign for those hoping the Fed will loosen monetary policy soon.

Market Reaction: Investors Cheer Softer Inflation

US Inflation stock futures turned bullish after the inflation numbers were released. Investors were reassured by the data, which suggests that inflation is not accelerating out of control:

-

S&P 500 futures: +0.4%

-

Nasdaq 100 futures: +0.5%

-

Dow Jones futures: +130 points

Tech giants led the pre-market rally:

-

Tesla surged ~3% after Elon Musk softened his political rhetoric

-

Apple, Microsoft, Amazon, Meta, and Nvidia posted gains between 0.4% and 0.7%

This positive market momentum also reflects growing optimism that the Federal Reserve may be compelled to consider interest rate reductions if inflation continues to moderate.

Fed-Trump Tensions: Battle Over Interest Rates

However, this economic backdrop is overshadowed by rising tensions between the US Inflation Federal Reserve and President Donald Trump. Trump has been pressing the Fed for aggressive rate cuts, arguing that high interest rates are stifling economic growth. In contrast, Federal Reserve Chair Jerome Powell remains cautious, emphasizing that monetary policy decisions will remain data-driven.

Powell recently remarked that “no rate cut will be considered unless there’s compelling evidence that inflation is consistently under control.”

The central bank’s next significant event is the Federal Open Market Committee (FOMC) meeting scheduled for June 17–18, where a fresh set of economic projections—including the influential “dot plot” showing policymakers’ rate expectations—will be released.

Changes in CPI Calculation: What You Should Know

An important structural change was also implemented this month in how the CPI is calculated. Starting with the release of April 2025’s data, the Bureau of Labor Statistics now uses transaction-based data for leased cars and trucks instead of survey data. This is expected to improve the accuracy of inflation measurements, particularly in sectors with frequent pricing changes.

This technical change aims to bring more transparency and precision to a metric that serves as the cornerstone of US monetary policy and global financial analysis.

Also Read: Top 5 Off-Road 4×4 SUVs Under ₹20 Lakh – Best Picks for Indian Terrain

International Relations and Trade: China-US Deal in the Spotlight

Beyond the inflation data, geopolitical developments are also affecting investor sentiment. The US and China are reportedly close to a new trade agreement. President Trump has declared that China will supply rare earth materials to the US up front, describing the ongoing relationship with President Xi as “excellent.”

However, the deal includes asymmetrical tariffs:

-

China to impose 10% tariffs

-

US to charge 55% tariffs

The final terms are still awaiting formal approval, but any positive movement on this front is expected to reduce uncertainty and support global markets, especially those reliant on rare earth imports and tech manufacturing.

What Lies Ahead?

While the May, US inflation report offers encouraging signs, uncertainty remains. The Federal Reserve is likely to wait for additional data before making any decisions. However, softer-than-expected inflation data gives the Fed breathing room, and markets are already pricing in a greater probability of a rate cut by the end of 2025.

Upcoming indicators to watch:

-

June CPI report

-

June 17–18 FOMC meeting outcome

-

US-China trade agreement confirmation

The US Inflation Report for May 2025 marks a pivotal moment in the economic narrative of the year. Despite a slight rise in the annual rate to 2.4%, all key metrics fell short of expectations—giving both the markets and the Fed some breathing room. As tensions between the White House and the central bank simmer, and global trade developments continue, the path of future rate decisions will depend heavily on the next few months’ data.